THE only BOOKKEEPING PROGRAM specifically FOR

SERVICE‐BASED BUSINESS OWNERS

who are serious about building a profitable businesS supported by an affordable virtual assistant

THE only BOOKKEEPING PROGRAM specifically FOR SERVICE‐BASED BUSINESS OWNERS who are serious about building a profitable businesS supported by an affordable virtual assistant

Take Control of Your Finances

and Fall in Love with Your Money!

Love Your Profit is the Only Program That Combines Money Mindset, Financial Mastery, and a Vetted Bookkeeping VA—So You Can Stop Avoiding Your Finances and Start Growing Your Profits

A New Way to Take Control of Your Finances and Finally Bring Home More Money From Your Business

Without Doing Your Own Bookkeeping!

Love Your Profit gives service-based business owners a proven path to clarity, confidence, and cash flow - with a vetted Bookkeeping VA doing the work behind the scenes (at around $6/hour).

This isn’t about forcing yourself to “get better” at bookkeeping.

It’s about finally having a financial system that supports you — instead of draining you.

You didn’t start your business to feel stressed about money… but if you can relate to any of these, you are not alone:

You’re bringing in revenue, but your take-home pay doesn’t reflect it

You worry you’re missing deductions or overpaying taxes

At tax time, you’ve said “next year will be different!” - but nothing changed

You’re paying your CPA or a local bookkeeper premium rates — but still don’t feel clear or supported

You’ve been doing the books yourself… and you’re over it

You’re avoiding your numbers completely because it just feels too overwhelming

If You’re a Coach, Real Estate Agent or Service-Based Business Owner who said

YES to any of the above... This Program was Created for You.

A Completely New Way to Manage Your Money

Love Your Profit isn’t about learning how to be a better bookkeeper.

It’s about stepping into the identity of a business owner who understands their numbers and makes confident decisions — without touching spreadsheets or “catching up later.”

Your Bookkeeping VA handles the details (usually around $6/hour).

You gain clarity, control, and cash confidence.

This isn’t just an improvement.

This is an upgrade to the way you run your business — and who you get to become.

Introducing the

'Love Your Profit' Program

Learn how to finally take control of your finances and

build a solid foundation for scaling your business.

What Our Clients

Have To Say

Make Sure Your Sound Is Turned On

Jeanne's Personal Experience

I used to dread bookkeeping. Everyday I would look at that pile of receipts on my desk and think:

When am I going to have time to input all those?

What if I messed something up?

Couldn’t I just ignore it until tax time?

Sound familiar? If you’ve ever felt the guilt and shame of ignoring your numbers—you’re not alone.

"With the help of my coach, Kirsten, I finally outsourced my bookkeeping, learned what actually mattered, and stepped into the role of a business owner who understands her numbers instead of hiding from them."

The Relief Was Instant —

And Honestly, I Didn’t Expect It to Feel This Good

The day I finally outsourced my bookkeeping? The relief was instant. Because for the first time, the work wasn’t on me. The system, the support, and my Bookkeeping VA carried the load — and that changed everything.

It was like someone lifted a boulder off my shoulders—the responsibility I’d been carrying for way too long.

For the first time in a long time, I felt creative again—I had space to dream, to plan, to build, without that constant mental clutter.

And honestly… I felt happier. Not just because my books were taken care of—but because I was finally acting like the smart, capable CEO I always knew I could be.

And that’s exactly

what we want for you.

The Clarity

The Space

The freedom to grow your business instead of being buried in the backend.

... program is how you

get there

Imagine waking up every day knowing exactly where your money is going, confidently making decisions about your growth, and having the support of a bookkeeping expert for just $6 per hour who handles the details.

Sounds like a dream, right?...It’s time to make that dream a reality.

The Love Your Profit program plus a vetted and skilled Bookkeeper Virtual Assistant is designed to help you master your money, shift your mindset, and become the confident CFO of your business—without the stress or confusion.

The Love Your Profit Program

is how you get there

Imagine waking up knowing exactly where your money is going — because a trained expert has already updated, organized, and categorized your books for you (usually in just 2-3 hours a month at around $6/hour).

Sounds like a dream, right?...It’s time to make that dream a reality.

The Love Your Profit program plus a vetted and skilled Bookkeeper Virtual Assistant is designed to help you master your money, shift your mindset, and become the confident CFO of your business—without the stress or confusion.

HERE'S WHAT'S INSIDE

MONEY MINDSET

Wealth Starts with Mindset

Before we ever get into numbers, we start with the foundation: your mindset. How you think about money shapes how you earn, spend, save, and invest it. In this section, you’ll learn how to shift from a survival mentality to the mindset of an empowered CFO—where your money works for you, not against you.

You’ll discover:

How your beliefs about money impact your business success

What building wealth really means as an entrepreneur

The link between financial clarity and confident decision-making

Why profit is not a “dirty word”—and how to make it your top priority

Love Your Profit doesn’t teach you bookkeeping.

It gives you a proven, supportive financial system that removes the stress, eliminates the guesswork, and helps you to make decisions like the CEO your business needs.

MODULE 1:

Introduction to Bookkeeping & The Love Your Profit Course

Bookkeeping isn’t just busywork—it’s the backbone of a healthy, thriving business. Done right, it helps you manage cash flow, maximize tax deductions, and make smart financial decisions. Done wrong—or ignored—it can lead to missed opportunities, financial stress, and business instability.

Here’s what you’ll master:

Step Into the Role of the Empowered CFO

Learn how to think like a financial leader, not just a business owner, so your money becomes a tool for freedom and growth.

Shift Your Money Mindset

Replace stress and scarcity with clarity and confidence by adopting a strategy-focused approach to your finances.

Organize Your Books with Ease

Discover simple systems to track income and expenses so you always know where your money is going (and where it’s coming from).

Unlock Tax Deductions & Write-Offs

Identify the business expenses you may be missing, maximize your deductions, and keep more of what you earn with confidence.

MODULE 2:

Choosing Your Bookkeeping Software

The right software doesn’t just save time—it makes your bookkeeping simpler, more accurate, and far less stressful. In this module, you’ll learn how to choose the best tools, set them up properly, and keep your financial data safe.

Here’s what we’ll cover:

Choosing the Right Bookkeeping Software

Learn what you need and don't need your bookkeeping software to do.

Introduction to Softwares

Hear about the top 3 bookkeeping softwares on the market for small businesses.

Comparison & Analysis

See the pros and cons of each of the top softwares and choose the best one for you and your business.

Tracking Mileage

Learn easy methods for keeping receipts in order and using mileage trackers to maximize deductions.

MODULE 3:

Hiring & Working with Your Bookkeeping Virtual Assistant

A skilled Bookkeeping Virtual Assistant (VA) keeps your finances accurate and frees you to focus on growth. In this module, you’ll learn how to create a smooth, productive working relationship with your VA.

Here’s what we’ll cover:

Communication & Cultural Awareness

Build strong communication habits and learn best practices for working with Filipino VAs to bridge cultural differences and build trust.

Scheduling & Time Zones

Set expectations around deadlines, response times, and monthly review meetings so you stay aligned no matter where your BVA is located.

Secure Documents & Payments

Use safe tools for sharing financial documents and set up simple, reliable payment methods for your BVA.

Systems for Success

Put the right processes in place so your VA can manage daily transactions, categorize expenses, and reconcile accounts with ease.

MODULE 4:

Setting Your Business Up for Growth

This final module brings it all together—showing you how to use bookkeeping not just to track your money, but to grow it.

Here’s what we’ll cover:

Profit First Method

Implement a simple system that ensures your business stays profitable and financially secure.

Smart Business Investments

Learn which investments generate revenue, improve efficiency, and support long-term growth.

Scaling with Support

Discover how hiring and leveraging your Bookkeeping Virtual Assistant can save time and free you to focus on growth.

Bonuses!

Plus, You’ll Receive 3 Essential Resources

to Make Implementation Easy

We don’t just hand you the training and send you on your way

— we’ve included practical tools that keep you organized and confident:

Downloadable Deductions Guide

A clear list of common deductions you may be able to take — so you don’t leave money on the table at tax time.

Personal Expenses Checklist

A simple tool to help you separate personal from business expenses — no more second-guessing what belongs where.

Program Cheat Sheet

A quick-reference guide that keeps the big picture and step-by-step tasks at your fingertips, perfect for when you want the “CliffsNotes” version.

These resources are designed to save you time, reduce confusion,

and make sure you’re getting the full benefit of what you learn inside the program.

This course equips you with the skills and strategies to confidently manage your finances, make smarter business decisions, and build a foundation for lasting success.

Take the first step toward mastering your bookkeeping and creating financial freedom today!

PLUS — You'll Walk Away With:

CPA-Ready Books

A vetted Bookkeeping VA for about $6/hour — and most clients only need 2-3 hours each month to stay completely caught up and organized

Understand exactly where your money is going every month.

Peace of mind at tax time (no more scrambling)

Lifetime access to course materials + templates

Live open office hours each month for ongoing support

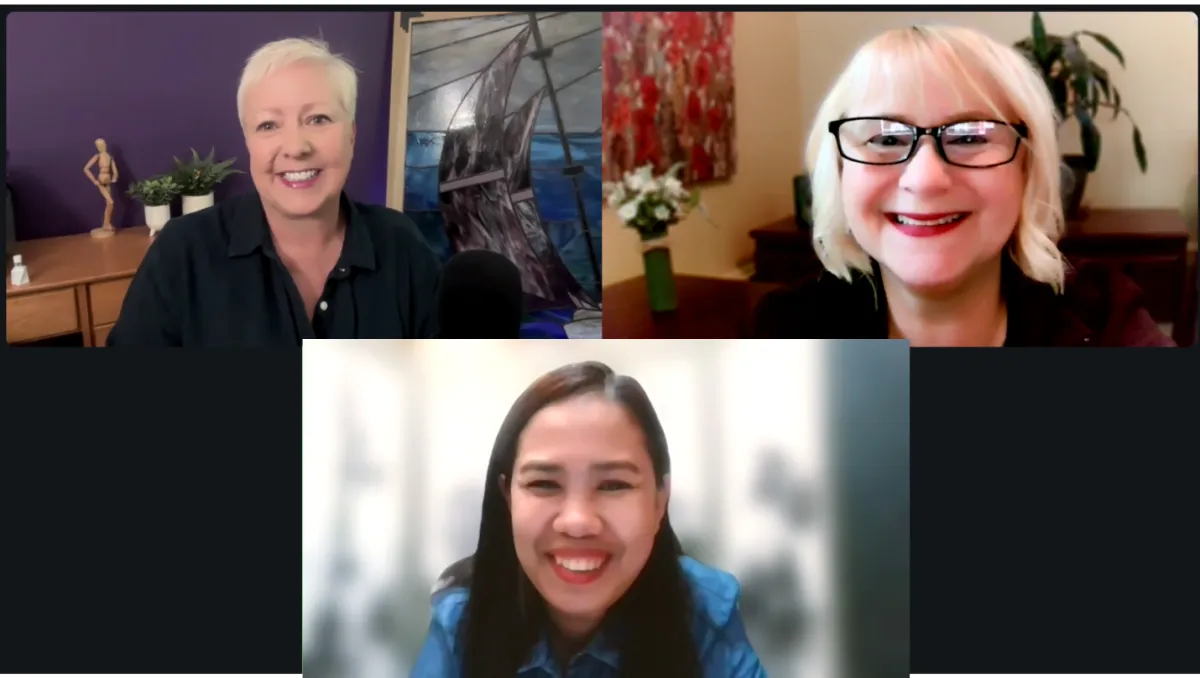

Meet Your Mentors

After a successful 20-year career in real estate, Kirsten transitioned into business coaching with a focus on outsourcing. She has worked with service-based business owners across industries, helping them hire and train hundreds of virtual assistants so they can allowing entrepreneurs to focus on what drives their business forward.

Partnering with Jeanne, a marketing strategist and systems creator who knows firsthand how delegation fuels growth, they’ve built programs that empower entrepreneurs to delegate effectively and stop carrying the entire load themselves. Together, they’ve combined their expertise to make outsourcing practical and profitable.

Today, their work extends beyond marketing. Through Love Your Profit, they provide affordable bookkeeping VAs and proven education that help entrepreneurs finally take control of their finances, make smarter money decisions, and step into the role of confident CFO.

Their mission is simple: to give business owners the clarity, support, and freedom they need to scale with confidence and create long-term success.

Our Mission

By the end of 2026, our mission is to empower 1,000 entrepreneurs to build wealth, create meaningful impact, and love their profit — with the support of a trained Bookkeeping VA (typically around $6/hour)

who keeps their finances clear, organized, and working for them.

Love Your Profit was born from our own experience

We began outsourcing 17 years ago, we have hired and trained hundreds of VAs for ourselves and our clients. So, when our bookkeeper in the US decided to retire, it only made sense for us to hire a Bookkeeping Virtual Assistant. We found the perfect bookkeeping VA, handed off our books, and developed a streamlined process that works.

It's been amazing to meet with our bookkeeping VA each month to review our P&L and balance sheet— something we didn’t do with our previous bookkeeper. This has allowed us to improve some simple but important things. For example, in the past, our income was lumped together, but our new bookkeeping VA asked us if we'd like to track income based on our different programs. This small change has given us better insight into our business and helped us make more informed decisions.

This program is the exact system we use in our own business, and it's the same one we believe every service-based business owner deserves.

Our mission is to help you take control of your numbers in a way that feels calm, empowering, and completely achievable—so you can confidently lead your business as the CEO (and CFO) you’re meant to be.

WHAT'S THE

INVESTMENT

One-Time Fee:

$1697

Video Modules with strategic training

Everything you need to know about getting your bookkeeping in order and working with a Bookkeeping VA (BVA)

We find the qualified BVA's for you!

How to choose the right software

Done-for-you hiring document templates

LIVE open office hours each month

And much more

Smartest investment you will make this year!

Frequently Asked Questions

Will the Bookkeeping Virtual Assistant need access to my bank account?

No. Your banking information is automatically imported into your bookkeeping software (like Zoho, QuickBooks or Xero). If needed, you can provide your Bookkeeping Virtual Assistant with bank statements, which do not include full account details.

Will the Bookkeeping Virtual Assistant do my taxes?

No, the Bookkeeping Virtual Assistant will not prepare or file your taxes. However, they will make sure your books are 100% CPA-ready, so whether you handle your own taxes or work with an accountant, you'll have everything organized and ready to go when tax time comes—without the stress of scrambling for paperwork.

How do I know the Bookkeeping Virtual Assistant is qualified?

We personally find and vet each Bookkeeping Virtual Assistant to ensure they:

✔️ Have real-world experience in U.S. bookkeeping.

✔️ Are proficient in QuickBooks, Xero, and other common accounting software.

✔️ Speak fluent English and have worked with U.S. business owners before.

You won’t have to waste time searching, interviewing, or testing candidates—we handle that for you.

How do I communicate with my Bookkeeping Virtual Assistant?

Your Bookkeeping Virtual Assistant will work directly for you, so you decide how you’d like to communicate! Most business owners use: WhatsApp, Slack and/or Facebook

Will there be a language barrier?

No! The Bookkeeping Virtual Assistants we match you with are fluent in English and have experience working with U.S. business owners.

How much will this cost me?

Your only costs are:

✔️ Your $1697 one-time investment in the program.

✔️ Your Bookkeeping Virtual Assistant’s hourly rate ($6/hour) - on average 4 to 5 hours a month =$30.

✔️ Your bookkeeping software $40-60/month, depending on your choice.

There are no hidden fees, agency markups, or long-term contracts—you hire your Bookkeeping Virtual Assistant directly!

How much time will I need to train my Bookkeeping Virtual Assistant?

Minimal! Your Bookkeeping Virtual Assistant already knows how to handle bookkeeping, and we provide:

✔️ An onboarding checklist to get them up to speed quickly.

✔️ Guidance on how to add them to your software and provide the information they need for a seamless transition

Most business owners spend just 1-2 hours upfront, then let the Bookkeeping Virtual Assistant handle everything moving forward.

What if I don’t like the Bookkeeping Virtual Assistant I’m matched with?

No problem! If your first Bookkeeping Virtual Assistant isn’t the right fit, we offer a free re-match guarantee within 60 days of hiring your Bookkeeping Virtual Assistant—so you’ll always have a Bookkeeping Virtual Assistant who meets your needs.

What if I’m behind on bookkeeping?

That’s okay! Your Bookkeeping Virtual Assistant can help you catch up on past months (or even years) of bookkeeping so everything is organized and ready for tax season.

Is my financial data secure?

Yes! Your Bookkeeping Virtual Assistant never has direct access to your bank accounts. They only work within your bookkeeping software and handle bank statements without sensitive information.

Who is this program for?

This is designed for service-based business owners (coaches, real estate agents, etc.) who:

✔️ Want organized, stress-free bookkeeping without doing it themselves.

✔️ Need affordable bookkeeping.

✔️ Are ready to step into the CFO role of their business and make smarter financial decisions.

What if I have more questions?

We’re happy to help! Just reach out, and we’ll answer any questions you have. [email protected]

You’re One Decision Away From Knowing

Your Numbers — and Trusting

Every Financial Move You Make

Imagine ...

Knowing exactly where your money is going every month.

No more

avoiding your numbers.

No more

tax season panic.

Finally feeling like the CEO (and CFO)

your business needs

And a Bookkeeping VA supporting you

for around $6/hour

If you’re ready to stop "figuring it out later" and finally ready take control of your money… join us.

One-time payment of $1697

Get paired with a personal Bookkeeping Virtual Assistant

Lifetime access to the training

The Love Your Profit Program

We find and vet qualified and experienced Personal Bookkeeping Virtual Assistants for you

Detailed Video Coaching & Training

Monthly LIVE Office Hours to support you

This program is the best investment you'll make all year!

If this tax season had you promising “Next year will be different”… let’s make sure it actually is.

Your books won’t magically get caught up.

Your clarity won’t appear out of thin air.

Your confidence won’t grow until your numbers do..

Let us help you finally stop avoiding your finances and build a business you can trust —

with a vetted Bookkeeping VA doing the heavy lifting for about $6/hour.

Love Your Profit is an official program of Six Figure Business Coaching | Term of Use | Privacy Policy |

© 2025 Six Figure Business Coaching, LLC | All Rights Reserved